VIEW: Relationships | RFA | ROI | Growth | Scoring

fabe offers financial advisors seeking to purchase/sale a business or gauge transition risk a systematic approach and comprehensive business valuations that give valuable insight on top-tier client relationships. Our proprietary technology measures and assesses the true value of client relationships that equip advisors with actionable business data to make high-confidence, informed business decisions.

fabe ranks and scores critical aspects of “Each and Every Client Relationship” creating appropriate weighted scores based on the client’s specific metrics. Advisors top 20% client relationships are meticulously analyzed to provide an in-depth view of the business.

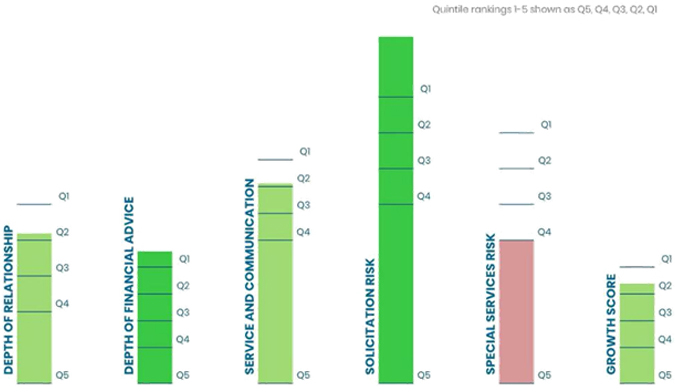

Relationship Analytics

Utilizing relationship predictive analytics provides users with insightful information to methodically make informed business decisions.

- Depth of Relationship

- Depth of Financial Advice

- Service & Communication

- Transition Risk

- Special Services Risk

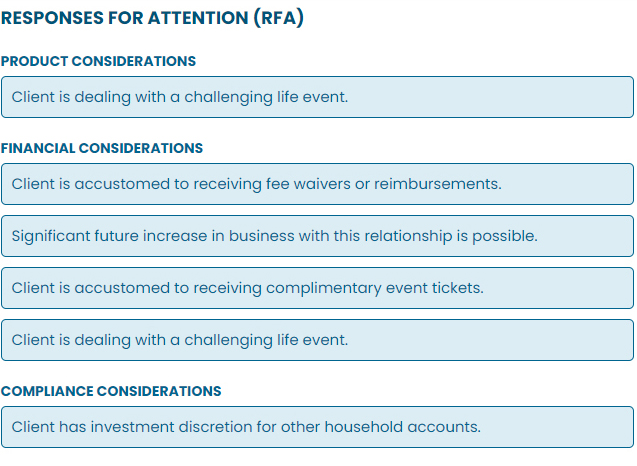

Responses for Attention

Highlights based on Advisor responses to fabe‘s questions:

- Product Considerations

- Financial Considerations

- Compliance Considerations

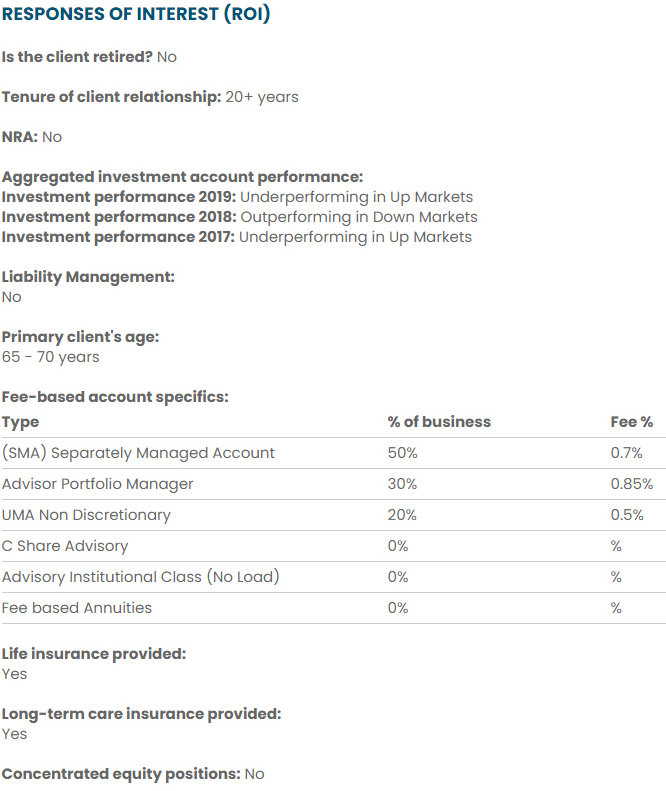

Responses of Interest

Noteworthy responses from Advisor responses to fabe questions:

- Product Considerations

- Financial Considerations

- Compliance Considerations

Fee/Performance Ratio & Growth Score

Fee Advisor charges relationship relative to historical account performance, and fabe proprietary growth score.

Private Client Weighted Scores

fabe ranks and scores individual client relationships in 5 categories; while also providing a separate growth and fee to performance score.

Advisor Business Quintile Ranking in each of the scored categories

Advisor Business is ranked using fabe‘s (5) Factors Client Evaluation score. Each client is weighted for production value then presented for quintile ranking.